I incorporated my business back in 2011, although I began working on it on and off a bit earlier. Since that time we’ve raised about $550,000 in venture capital, but over the years I’ve been weaning us off the VC juice. Still, it’s nice to be able to get access to capital to grow the business. But when you aren’t yet consistently profitable, that could be hard. Luckily, there is a new breed of business loan options that have been cropping up over the years. One of those is LoanBuilder which is now owned by PayPal, and this is my extensive LoanBuilder review to help you decide if it’s right for your needs.

It’s a product that’s easy to qualify for, and easy to access. I’ve recently paid off our second LoanBuilder loan, so I’m going to walk you through my experience and what I like and dislike about the program.

I’ll start with a brief overview of what the LoanBuilder loan is and what it takes to qualify. Then I’ll review the program on six criteria, ranking them on a scale of 1-5: ease of application, fees & rates, structure & repayment, sales pressure, speed of funding, and loan amount.

This is the type of review I wish I would have had before taking our first LoanBuilder loan. My hope is that it’s comprehensive, but if you feel like I’ve missed something, please pipe up in the comments so I can add it. Let’s get started.

LoanBuilder: What is it and how to qualify

LoanBuilder loans are designed for working capital. The goal is to give small businesses access to cash that they can leverage for a positive return on investment. This could be anything from buying inventory to hiring.

The loan is paid back on a daily basis, but has no minimum payment criteria beyond the requirement that at least 10% of the loan and fee be paid back every 90 days. So unlike a traditional loan, like a mortgage, you aren’t making a set payment every month. I’ll get more into this in the later section where I’ll cover fees & rates and structure & repayment.

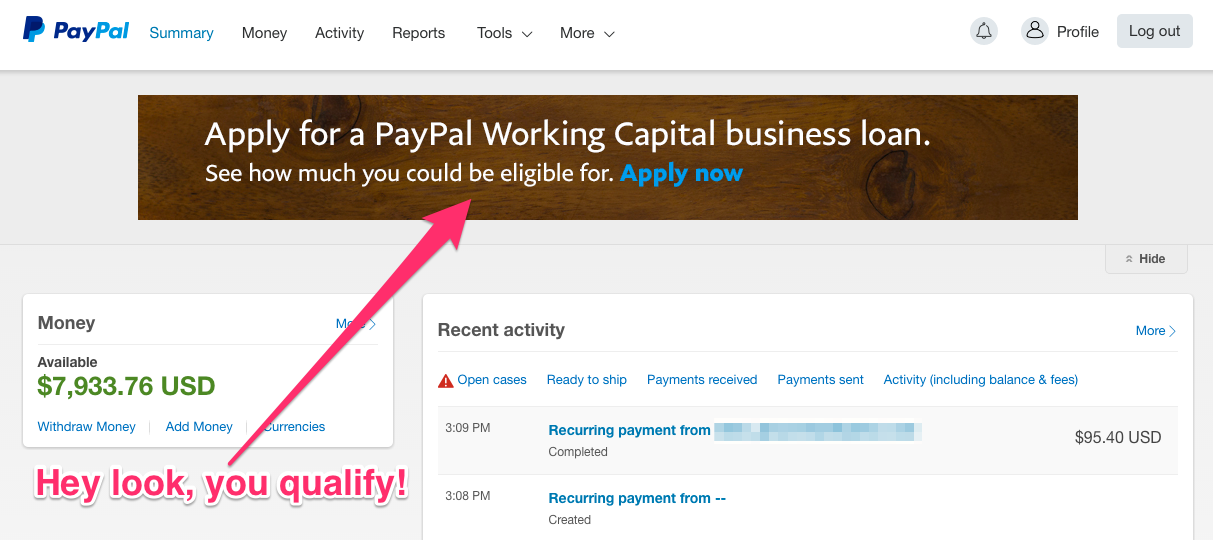

If you’re a small business processing payments with PayPal, you may not have even been aware that their LoanBuilder program existed until you crossed a specific milestone. To qualify, you must have been processing payments with PayPal for at least three months and have $20,000 or more in transaction volume in the last twelve months. Once you cross those thresholds you’ll likely start seeing advertisements in your PayPal dashboard like this:

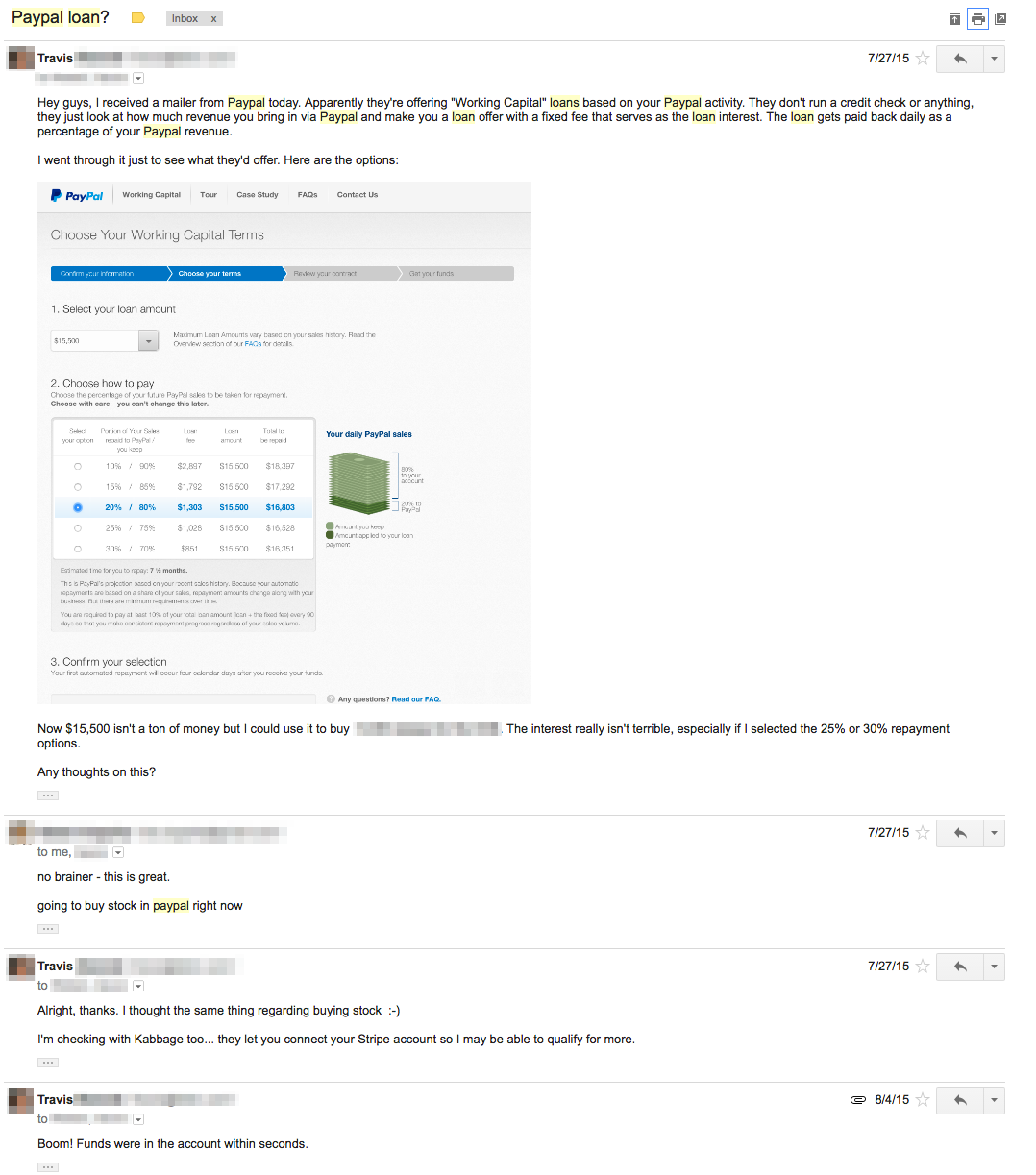

If your experience was anything like mine, you clicked through, did the crazy short application, and stared at the money you could have instant access to wondering, “is this too good to be true?”. That’s exactly what I was thinking, so I shot an email to two of my advisors to get their thoughts:

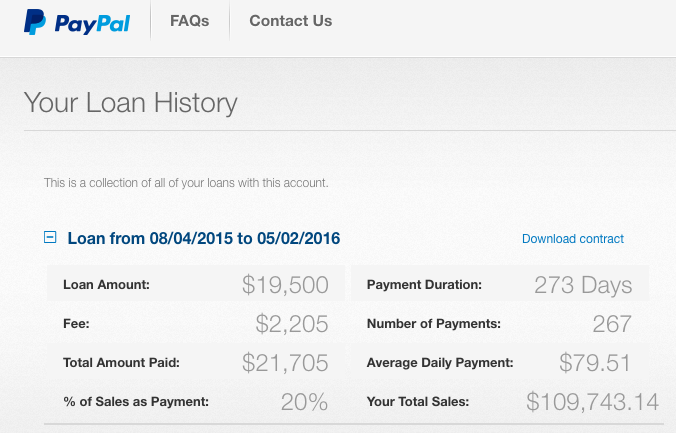

So we took our first loan in August 2015 and just paid off our second loan in mid October this year. We’ve obviously been happy with it, but how happy? Let’s dive in to the five criteria I’ve been using to evaluate business loan lenders and see.

LoanBuilder review evaluation

As I mentioned in the introduction, my LoanBuilder review is evaluated on six criteria: ease of application, fees & rates, structure & repayment, sales pressure, speed of funding, and loan amount. If there’s something on this list I’m missing please let me know. I’m happy to add it!

LoanBuilder review: Ease of application

LoanBuilder applications are incredibly fast and easy, that’s largely why I was hesitant to initially accept the loan. It was so fast and easy it seemed like there just had to be something I was missing! Spoiler alert: there wasn’t.

The bulk of the application happens in the background without you even knowing it. That’s the qualification process of having at least a three month history with PayPal and transacting at least $20,000 in the last twelve months.

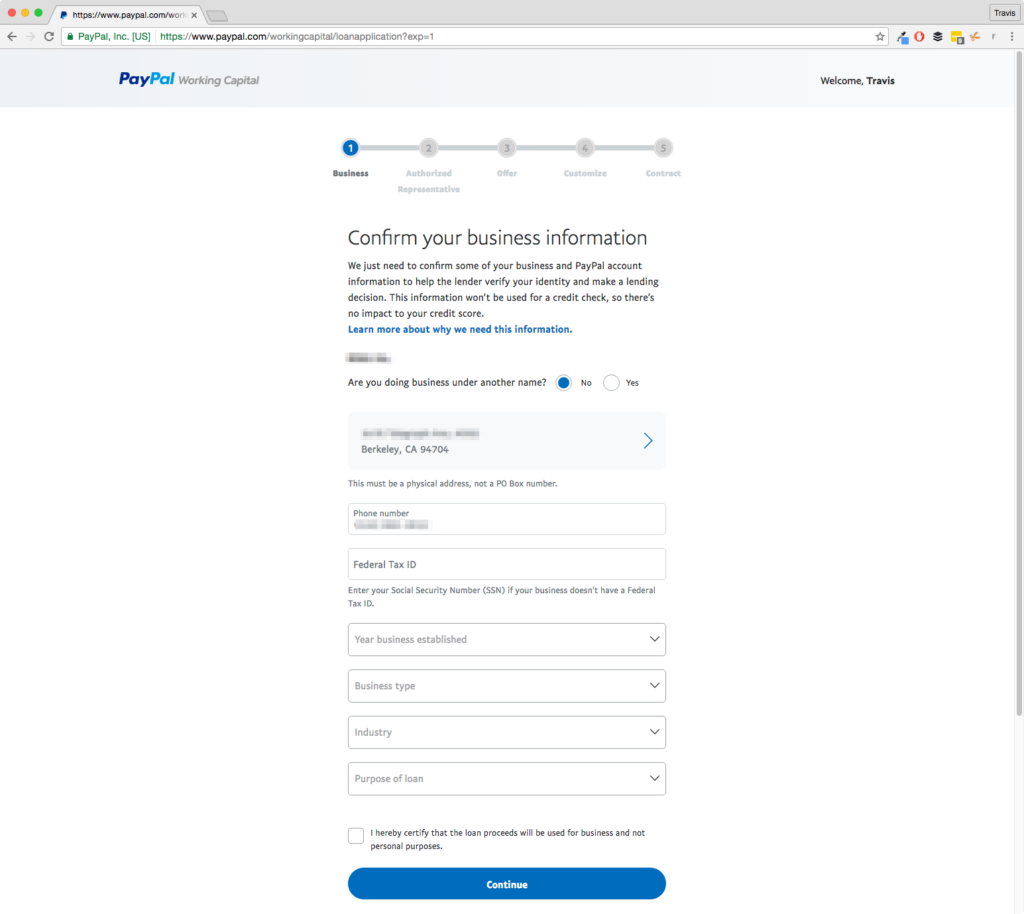

But what happens when you click that big banner that is advertising the LoanBuilder loan? You’re presented with this screen:

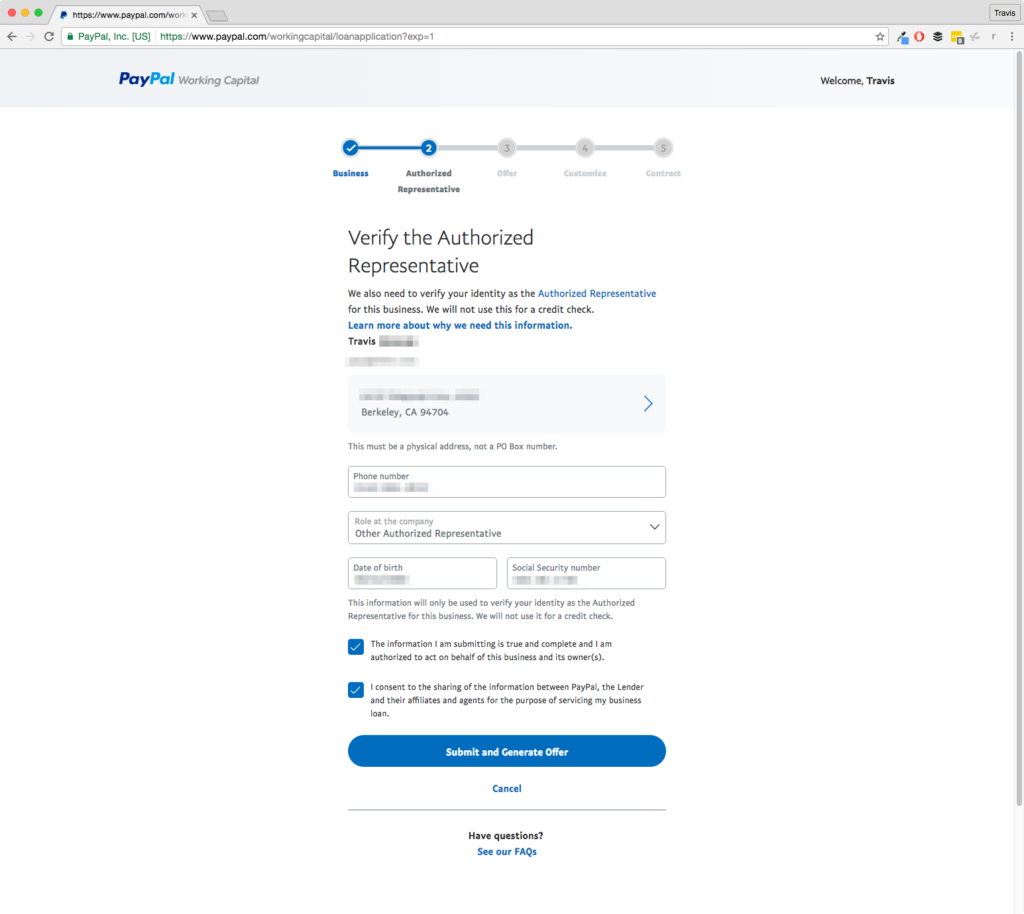

The first step is simply confirming some business information. Easy enough. This page should take you all but half a minute depending on how long it takes you to hunt down your EIN (I think I’m down to a solid 12 second on that!). You’ll then see another even shorter page where you basically confirm you have the power to take a loan in the company’s name:

That’s it! That’s the entire application process. It’s quick (literally less than a few minutes), easy, and painless. That’s why I give this criteria a perfect score.

score: 5/5

LoanBuilder review: Fees & rates

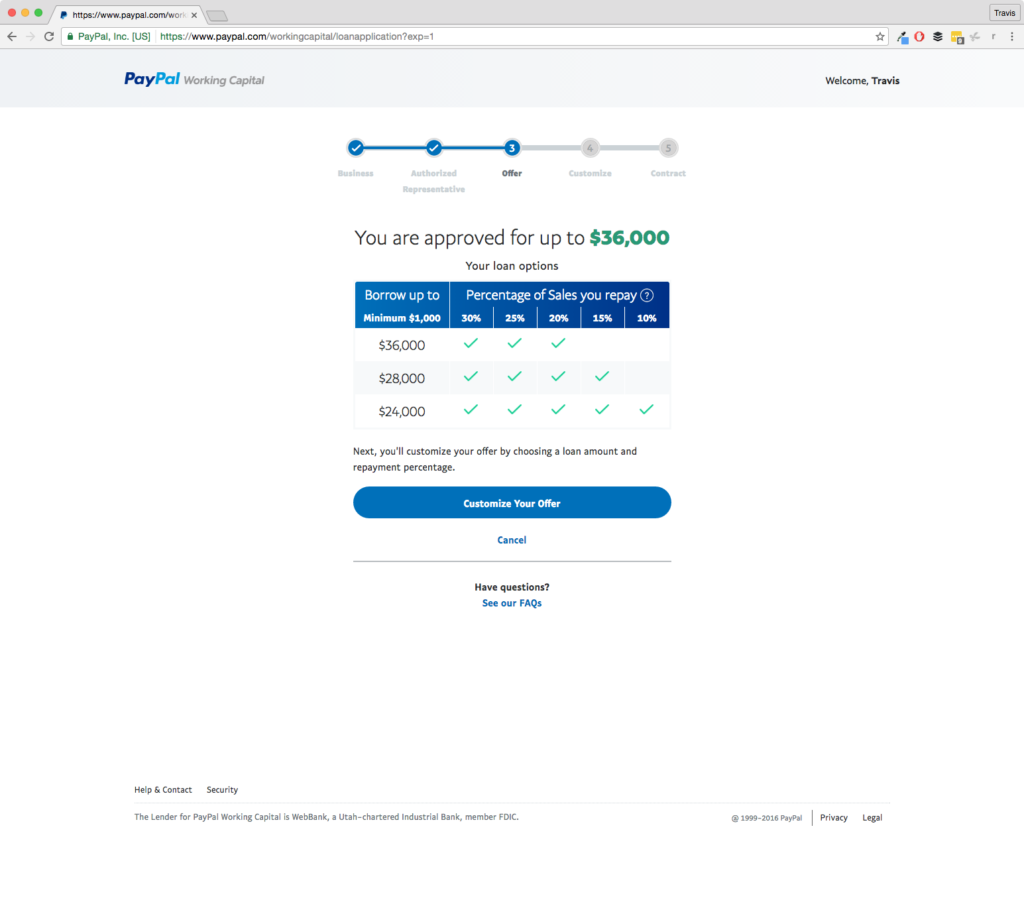

Once you verify that you’re an authorized representative you’ll wait slightly longer than it took you to fill out the last two pages (up to 45-second according to the screen… so like, nothing) and be presented with your shiny loan offer:

This is the point where you’re either super excited or drastically disappointed. If it’s the latter, well look on the bright side… at least you didn’t spend days or weeks applying for the loan. Heck you hardly spent minutes!

Once you click the “customize your offer” button you’ll be able to select the loan amount you desire.

LoanBuilder review: Analyzing LoanBuilder loan fees

In this real-life example, we qualified for a maximum loan of $36,000, but there’s more to evaluating the loan than just choosing an amount.

As you can see in the above image, the fees vary depending on the amount you decide to take and the repay amount (I’ll talk more about this repay amount in the next section, “structure & repayment”). LoanBuilder even gives you an estimate, based on your previous transaction history, of when the loan will be paid back. But it’s important to understand how much this loan is truly costing you. And I recommend calculating the annual percentage rate (APR) for each scenario.

Calculating annual percentage rate (APR)

Without calculating the LoanBuilder loan’s true APR it’s difficult to understand the full cost of the loan. If you have an aversion to numbers don’t worry… it’s actually pretty easy. The Consumer Federation of America explains how to calculate APR for payday loans. And since this loan is fee-based, we can use the same formula to calculate the APR of our LoanBuilder loan. The article uses the example of a $350 payday loan with a $50 fee that needs to be paid back in seven days.

Here’s what needs to be done:

1) Divide the finance charge by the loan amount

2) Multiply the result by 365

3) Divide the result by the term of the loan

4) Multiply the result by 100

APR calculation example

Let’s run some numbers on one of our above options. Let’s say we decide to opt for the full $36,000 with a replay of 20%. PayPal estimates this will take 11 months to repay. That leaves us with a $7,063 fee. Let’s run through our four steps to calculate the APR of the loan:

1) $7,063 (our finance charge) divided by $36,000 (our loan amount) equals 0.19619444

2) Multiplying this by 365 equals 71.61097

3) The term of the loan is estimated by PayPal to be 11 months, or 30.42 days on average (thanks Google!), so that’s a total of 335 days (rounding up here because you can’t have a fraction of a day on a loan). So, 71.61097 divided by 335 days equals 0.21376

4) Multiply 0.21376 by 100 to get our APR percentage… that’s 21.38%

Is it unreasonable?

So that’s our true APR. Now, 21.38% sounds rich, and it is. But let’s consider the circumstances… we’re getting money without a credit check, without collateral, nearly instantly, and no requirements for bank statements or any other paperwork. When you look at it from that perspective, it’s reasonable.

This is just one combination of loan amount and fees. You could choose to pay back a higher percent of your daily transactions, and this would reduce your APR.For example, taking $36,000 and opting for the 30% of sales repayment yields a 17.08% APR. If you want to run the math on the scenarios in the above graphic (you know, without watching it over and over again), feel free to simply right click the graphic and save it to your computer. Then you’ll be able to click through frame by frame. You’ll thank me, I swear.

Fees & rates conclusion

The annual credit card APR is 14.9% (again, thanks Google!), so 21.38% seems at least somewhat reasonable. I also have the benefit of having compared LoanBuilder’s loan to other business loan options (like my Kabbage loan review) and it compares pretty favorably.

Overall, I’m subtracting half a point for having an APR higher than most credit cards and another half point because, based on my other experience with business loan lenders, this is not the best rate I’ve seen.

score: 4/5

LoanBuilder review: loan structure & repayment

Our third criteria for this LoanBuilder review is the loan structure. Specifically, we want to look at what the payback terms are, does LoanBuilder credit you for paying the loan back early, what’s the frequency of repayment, etc.?

How LoanBuilder loans are structured

We already know that the LoanBuilder loans are structured with a set fee. The fee is determined on how much money you wish to access and how much, in percentage terms, of your daily transaction volume you wish to pay back toward the loan each day.

There is no set APR like a traditional loan or a set payback period. So the loan is fee-based rather than yield-based. There are no other hidden costs. Many business loan providers will charge you an origination fee. There’s nothing like that here.

How LoanBuilder loans are repaid

LoanBuilder loans are unique to other business loan providers in the fact that they control the flow of money via PayPal. What this means is that PayPal sits between your funds and your bank account while other business loan providers are on the outside looking in.

This is a big competitive advantage for LoanBuilder, because it essentially de-risks your loan a bit for them. They don’t have to rely on you making payments manually. Think of it like your rent getting paid to your landlord directly from your paycheck before it hits your bank. You don’t have to do anything to make sure your landlord is paid on time.

That’s exactly how LoanBuilder repayments works.

Daily repayments with LoanBuilder loans

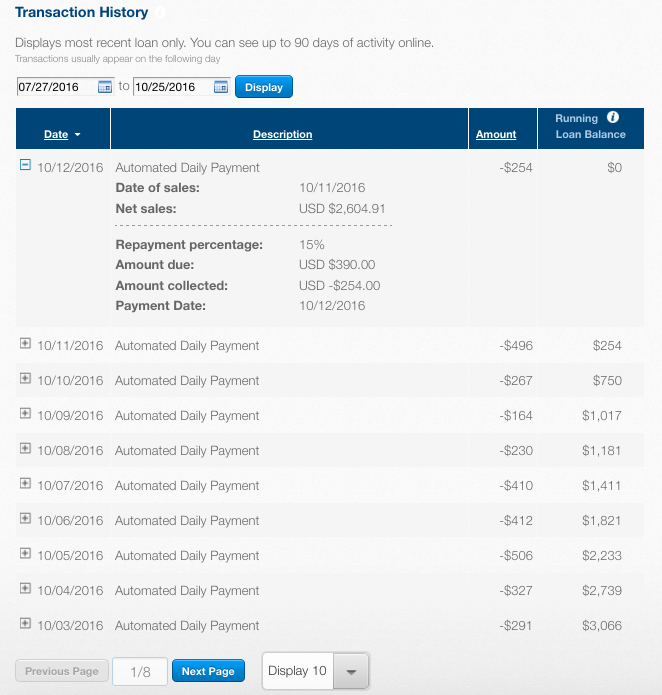

Every day, LoanBuilder will look at your total PayPal transaction volume and debit the percent of sales you selected to repay the full loan, including the fee. That sounds a bit confusing, so let’s use our example of taking the full $36,000 with the option to repay 20% of sales.

Remember, this option comes with a $7,063 fee for a total loan balance of $43,060.

Now let’s say the next day you transact $1,000 in PayPal, meaning you generated $1,000 in sales. The next day, 20% of this, or $200, will be debited from your PayPal balance and applied to your total LoanBuilder loan balance. That would leave your loan at $42,860.

This process will happen every day until the loan is paid back in full.

Flexible payback with LoanBuilder

This is one of the things I really like about LoanBuilder loans. Payments are flexible. That means if you have a really busy period, you’ll pay back more of your loan. But if you suddenly have a slow period, you’ll be paying back less (in dollar terms). Remember, your daily repayment is always based on a percentage of sales.

This can be attractive to businesses that see fluctuations due to seasonality (most do). For example, if you’re busy during the holidays but slow in January and February, it’s nice to know that you don’t have a fixed repayment amount that you’ll have to satisfy regardless of how much revenue your business is generating.

LoanBuilder review: Early repayment

But LoanBuilder loans fall short when it comes to early repayment. If you suddenly generate more revenue than you were expecting and want to get the debt monkey off your back, you might consider paying extra on your loan… or would you?

With the LoanBuilder loan there is no incentive to repay your loan early. You could, but you’re still paying the full loan amount and full fee amount. This is where LoanBuilder could drastically improve their offering. Other business loan providers credit back your fees if you pay your loan off early.

And the thing that makes LoanBuilder loans so attractive is what works against them in this category. With their flexible payments as a percentage of sales, it’s impossible for PayPal to know exactly how long the term of your loan will last. This makes it a bit more complicated for them to determine how much of the loan fee to credit back on an early repayment. But it’s not impossible.

For example, like a mortgage, LoanBuilder could apply X% of your daily loan payment to the principle and X% to the fee. On our 20% repayment example, this could be something like 2% daily to the fee and 18% to principle. That way, if you repaid the loan early, you’re simply paying down the principle and no longer on the hook for the rest of the fee. This improvement would make LoanBuilder loans a slam dunk.

Structure & repayment conclusion

I’m a huge fan of LoanBuilder’s flexible payment schedule, allowing you to pay a percentage of your revenue rather than a fixed daily, weekly, or monthly payment. This is a huge positive to any business that sees fluctuations in revenue, whether that’s seasonally or month to month.

But LoanBuilder falls short on early repayment. There’s absolutely no incentive to repay your loan early, and that’s unfortunate. Every other business loan provider I’ve evaluated incentivizes you to repay early. Fees are a big part of a loan, so I subtract one and a half points from this category’s score. Ouch.

score: 3.5/5

LoanBuilder review: Sales pressure

If you’ve ever filled out a loan application you know that the immediate sales pressure can be relentless. I hate this. I like to shop around, do my own due diligence, and avoid speaking with someone until I’m already 90% sure of my decision, if not 100%. Some companies make this impossible, but not LoanBuilder.

In fact there is zero sales pressure from LoanBuilder to take one of their loans. Sure, you’ll see the advertisements in your PayPal dashboard pretty regularly, but that’s pretty passive. Nobody calls or emails you trying to convince you to take out a loan. Even after multiple times looking at my loan options, I still don’t receive sales inquiries.

And I love that.

When it comes to business loans, sales and customer service tend to be one in the same. So what happened when I called LoanBuilder with some questions after we paid off our first loan?

Interacting with sales/customer service

If you’ve ever interacted with PayPal’s regular customer service, you know it’s an absolute nightmare. Don’t even get me started! So I wasn’t looking forward to calling their LoanBuilder division. Turns out, I was pleasantly surprised.

I was connected with a human almost immediately (I know, funny how that’s become rare these days) and she was both friendly and knowledgable. We’d just paid off our first loan, and I was hoping there was some way we could qualify for more. The only way to qualify for a higher loan amount is to have greater PayPal transaction volume. I’ll talk more about this in the loan amount section.

At the time though we were using a hybrid of Stripe and PayPal to accept transactions from our website. I’d mentioned this several times to the customer services/sales representative. In fact, about 80% of our business revenue was processed through Stripe. See what I’m getting at here? It’d be super easy to bolster our PayPal transaction volume by switching our entire payment system to PayPal.

Finally, I mentioned this to the representative saying, “I’m surprised you haven’t suggested that we do that yet”. Her response, “Well… yes, it crossed my mind. But we try not too be too pushy when it comes to sales”.

Breathe. Of. Fresh. Air.

We actually decided to take another loan and then proceed to switch all of our payments away from Stripe so that we were solely using PayPal to build a larger transaction history and qualify for a large loan. We did this back in May, so we’re still building that history.

Sales pressure conclusion

LoanBuilder does almost no selling for their loan product beyond passive ads on your PayPal dashboard. Even their customer service representatives focus on being helpful rather than selling. Although this may be to their detriment (maybe not though!), I greatly appreciated it. No pressure, no pushy sales people, and no unwanted phone calls. That’s a five out of five in my book.

score: 5/5

LoanBuilder review: Speed of funding

Getting quick access to your loan is an important factor, and it’s something that’s not difficult to solve. Having funds in your bank account in one business day isn’t too much to ask. And anything longer than 2-3 business days just shouldn’t happen.

LoanBuilder doesn’t disappoint in this regard. In fact, they do you one better. Funds are immediately available in your PayPal account once you complete the loan request. So if you never need the funds in your bank account, and can leverage the loan simply from your PayPal balance, the funds are available immediately.

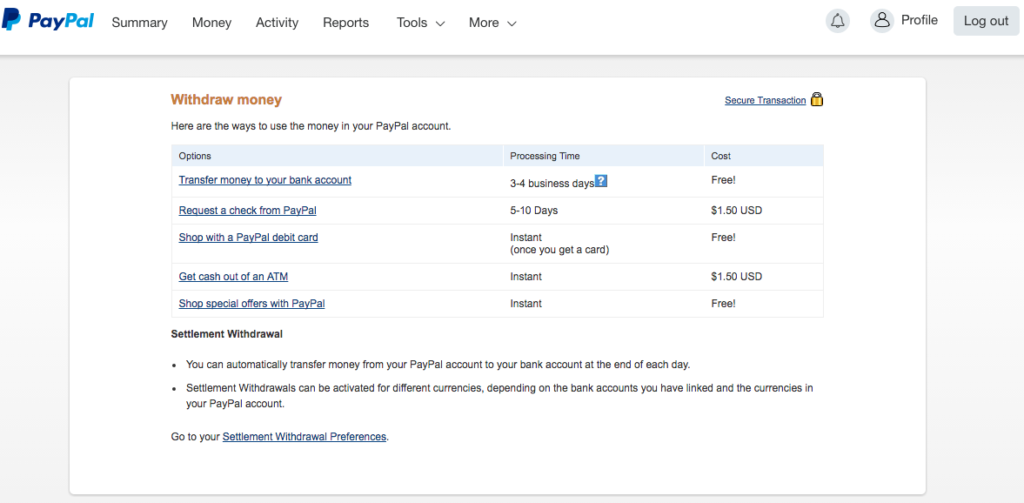

But if you do want the funds in your bank account, it works just like a regular withdrawal.

PayPal notifies you that withdrawals to your bank account can take 3-4 business days, but I always find that my withdrawals have arrived by the next business day. So no complaints here (as it should be).

score: 5/5

LoanBuilder review: loan amount

The total loan amount you qualify for can vary wildly. With one lender, we qualified for a line of credit of up to $17,000 or a term loan of up to $45,000. With another company we qualified for a line of credit of $100,000. PayPal offered us a maximum loan of $36,000. So the spectrum is wide here.

The more money you have access to, the better… assuming it’s at a favorable rate. And if you need $20,000 to make your investment work, well… you aren’t going with the lender offering you $17,000.

How LoanBuilder determine their loan amount

LoanBuilder has a simple formula for determining your maximum loan offering. They look at your last 12 months of transaction volume and offer you up to 15% of that value. So if you sold $100,000 worth of goods or services via PayPal in the last 12 months, they’d loan you up to a maximum of $15,000.

It’s an easy to understand formula, but perhaps a bit conservative.

LoanBuilder caps your maximum loan offering

The maximum LoanBuilder will ever loan a company is $85,000. So even if you processed $1,000,000 in sales in the last 12 months, you’re not able to get a $150,000 loan. Bummer.

In fact, once we repaid our second LoanBuilder loan in mid October, I started shopping around largely because of the $85k loan cap. We were planning on waiting until January and taking a $95,000 loan. But then I recently saw the small print about the $85,000 maximum loan. So I started wondering what other options we might have.

Loan amount conclusion

As I mentioned previously, I evaluated two other business loan providers. One offered us far more than LoanBuilder was offering us while the other offered us far less. I’ll be reviewing both companies in the coming weeks.

That said, there’s a lot of room for improvement here with LoanBuilder’s offering. We’ve successfully taken and paid back two loans in the last two years. Surely that should count for something, right!? LoanBuilder should take that as an indication that we’re a high-quality borrower and present less risk on another loan. Why not offer us more than 15%? For these reasons, I’m deducting a point for this category.

score: 4/5

LoanBuilder review conclusion

Overall, LoanBuilder’s program is quite strong with an overall score of 26.5 out of a possible 30.0; that’s an 88%, or B+ grade. Not incredible, but a pretty solid showing.

It’s easy to obtain a LoanBuilder loan without being bombarded by sales people. In fact, you don’t have to talk to anyone! Funds arrive quickly, and you have immediate access from your PayPal account.

Related: If you loved this review you’ll also love my extensive Kabbage loan review.

The drawbacks boil down to a few things: It’s a pretty high APR, something we’d expect from this type of loan, but high nonetheless. Further in the rates & fees category, there’s absolutely no incentive to repay the loan early. Most lenders will waive the portion of fees that would be due on the remaining term of the loan.

Finally, while LoanBuilder does offer a pretty decent loan amount, there is room for improvement on this front. The max limit is $85,000, they don’t consider your loan history if you’ve successfully paid off LoanBuilder loans in the past, and other business loan providers might offer you more capital like they did with us.

But even with these shortcomings, the LoanBuilder loan is competitive and any business looking for a working capital loan should consider it.

Thank you for thIs review and all that it contains…completly blows away ANYTHING and EVERYTHING else I have seen online. Perfectly done, covered just about everything.

I now qualify for a Paypal Working Capital loan, however I do not know how to proceed.

The reason: When I created this Paypal account, I had absolutely no idea what I was going to be doing with it. Making the amount of money I have made with it, let alone being able to take out a loan from Paypal were not even concepts in my brain yet. For that reason, I used a fictional name on the account, let’s say James Jones. When Paypal required more info after I made a certain amount of money or transaction, I followed Paypals instructions and upgraded my account to a business account, and I created a corresponding business (LLC) and received a EIN.

So the first part of the application is a breeze, fill in my business info with EIN, and onto the next screen. However the second screen…this is my roadblock.

The problem: The application now asks for the information (SSN and birth date) of a Authorized Representative in order to continue the application. The Authorized Representative Paypal has listed is James Jones…the fictional name I used when I first naively created the Paypal account. And although the application implies the Authorized Representative can be changed, it cannot.

So…I’m stuck at the moment. Any ideas on how I can continue? Any possibility it would work if I just go ahead and use my SSN or a family members (with permission of course)? I just doubt it would work because they are going to be looking to match the SSN and birth date to the fictional name, not mine or a family members. And I’m scared to even try as I am worried entering un-matching information will flag me or something and not allow me to apply again. Ughhhh I really wish I would have known how serious my Paypal account was going to become when I first created it! Any help from anyone would be MUCH appreciated!

And thank you again to the author for providing such a great review and resource for anyone interested in a Paypal Working Capital loan!

Hi Five5tar, I’m really happy you found the PayPal Working Capital loan review so helpful.

I don’t think you’re in that much of a bind. My initial suggestion would be to try changing the name on your PayPal account to your actual name. You can do this in your PayPal account settings (https://www.paypal.com/businessprofile/settings/). Remember, the Working Capital program is tied to your PayPal account, so I believe this should work.

If that doesn’t work for some reason, give PayPal Working Capital a call at 1-877-981-2163 (they’re open Mon.-Fri. 9am-8pm EST). I know… I’m not wild about calling customer support either, but as mentioned in the post, their support is pretty great. I have no doubt they’d be able to help you sort out this issue.

Lastly, once you do see how much you qualify via the PayPal loan and the payback fee, make sure to weigh your options. Read this post on my Kabbage loan review. It’s a beast just like this one, but (spoiler alert), you’ll likely qualify for more of a loan and a smaller fee.

If you have any more questions, just let me know. I’m happy to help, and I have experience with a lot of these working capital loan options.

I hope Mr. Downing wrongly calculated the APR because of a mistake or ignorance and not on purpose. The fact is that 21.38% is WAY BELOW the real APR.

If you want to calculate the APR perfectly, use a cash flow table and the IRR function in Excel.

What I am going to do is not even the “perfect” way to calculate the APR, but it’s a good approximation.

$7,063 (the finance charge) divided by $36,000 (the loan amount) equals 0.19619444, or 19.62%. And that’s for 11 months.

Every time you pay the loan back, part is interest and part is principal. When you start, you owe $36,000. When you finish, you owe $0. If you imagine this as a straight line, that starts at $36K and ends up at zero, during the whole loan term, on average, the principal owed is $18,000.

So, you end up paying $7,063 interest for an average $18,000 principal… that’s 39.24% interest. And that’s only in 11 months. To calculate the APR (1 yr rate), it’s not done dividing by 11 and multiplying by 12, although that’s a good approximation in this case. That would give us a 42.81% APR.

If we want to correctly calculate it, the APR (1yr) rate for 39.24% interest in 11 months would be (1 + 0.3924)^(12/11)-1 = 43.5%. Pretty close to our approximation of 42.81% APR.

In any case, 43.5% is much more “rich” than the 21.38% mentioned in the article.

I must say I have asked different “funding” companies and the lowest I have found was 22% APR and some went up over 100% APR. It’s sad that most people don’t understand how to calculate APR and take this loans that are much more expensive than they think.

Hi Ben, thanks for the comment!

I have no idea how you come to this conclusion,

I outlined my methodology on how I calculated the APR based on the Consumer Federation of America’s formula for payday loans. There is no “interest” in this loan like a traditional loan, so I’m not sure how you come to the idea that the principal is only $18,000. It is indeed $36,000 with the $7,063 being paid as a fee. That is, if taken, this loan provides you with $36,000 in working capital but you are required to pay back $43,063.

Paypal calculates that this loan will take 11 months to pay back given the accounts historical gross receipts. It seems you’ve overthought this and perhaps aren’t completely clear on how the loan functions.